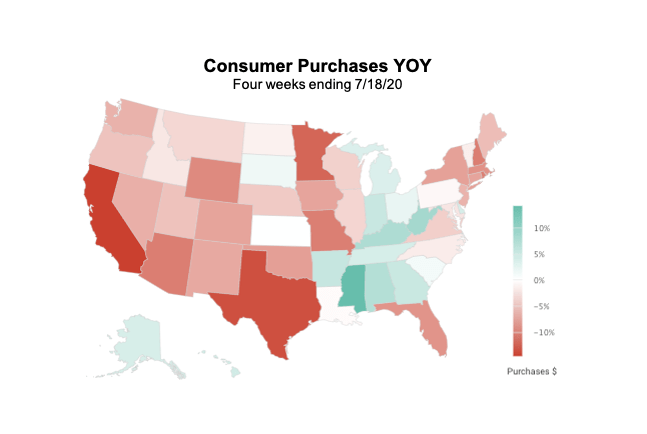

Consumer Spending Overall and By State

Consumer card spending nationally was still 3.1% behind 2019 over the most recent four weeks of available data (6/21/20 – 7/18/20), but the results vary widely by state. Where COVID-19 cases have surged, sales remain further behind 2019. Consumers in CA, TX, AZ and FL collectively purchased 12.6% less than they did last year. Some midwestern states are actually ahead of 2019 in consumer spending. In MI, OH, IN and KY, consumer purchases were up 3.9% over the past four weeks.

Trends by Category

People in all states are staying home more and trying to limit their potential exposure to COVID-19. This has driven a further shift towards online shopping where sales are up 20.9% vs. last year. In-store purchases are down 12.9%. These trends impacts some categories more than others. In-store sales at department stores were 53.1% behind 2019 over the past four weeks, and clothing store were down 32.5% in-store as well. With Nieman Marcus, J.C. Penney, Stage Stores, Ascena, Brooks Brothers, J.Crew, Aldo, and Lucky Brand already having declared bankruptcy this year and many other chains closing stores, future projections will need to combine both shifting consumer shopping habits with the reality of fewer distribution points.

The hardest hit area of consumer spending, however, is still travel, with spending down 65.9% over the four weeks ending July 18th. Airlines and online travel agencies are down 78.8% vs. last year. Auto rentals have begun to recover from April lows, but are still trailing 2019 by 41.6%.

While consumers are largely not traveling, they are not just sitting at home watching Netflix. Sporting goods and hobby store purchases are up 44.9%; Hardware and home centers are up 25.7%. So too are mass discounters and wholesale clubs, which are up 27% and 17.4% respectively. Even in these areas where consumers are spending more, online purchases have accelerated. For these five retail categories, online sales were up 50.7% vs. in-store which were up 8.9%. It’s worth noting that in-store card purchases are likely higher than actual in-store sales due a shift from away from cash during this pandemic.

Stay On Top Of Consumer Spending Trends

For weekly updates on consumer spending by category, state/county, online and offline, check out the new, FREE version of Commerce Signals Consumer Spend Impact Tracker. All of the data in this article is pulled from it.